Yes Bank may deliver 50% returns within 1 year. Here’s Why

- akshay.equity

- May 7, 2019

- 3 min read

Top 8 reasons:

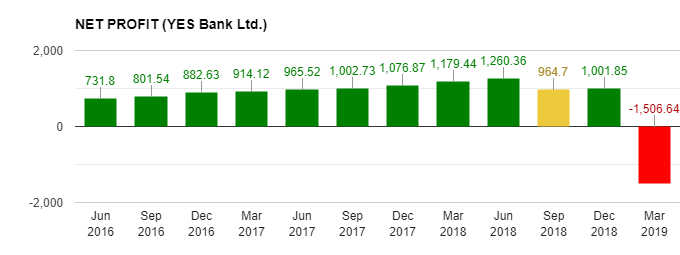

1. On April 26, the bank reported its first-ever quarterly loss since its inception in 2004. But very few people know Why? Let me tell you:

. Provisioning of 552 Cr done for Jet Airways.

. Provisioning of 529 Cr done for Stressed infrastructure conglomerate (IL&FS).

. Contingent provisions of 2,100 Cr to clean-up the balance sheet.

What exactly Provisioning is?

A large part of the money that Banks run on is Public’s Money. When a Loan that a Bank has lent is not performing (not generating any interest, the sole purpose for which it was lent), the account is called non-performing. When a loan is not being repaid, the Bank has to reconstitute this Money from its other sources like Profit. Setting aside of money from Profits to compensate a probable loss caused on lending a loan is called Provisioning. Provisioning is done to cover risk. It is like writing your money under different headings.

Provisioning is a temporary issue, so this is clear that the March quarter loss of the bank was driven by higher credit costs for non-performing loans and the creation of a contingent provision against a pool of identified stressed assets.

Nevertheless, the bank is profitable on a full-year basis, with a return on assets of 0.5% as of March 31, as against 1.4 % a year ago. Company has good consistent profit growth of 26.56% over 5 years.

2. Board has approved raising 20,000 Cr via debt and $ 1 Bn via equity.

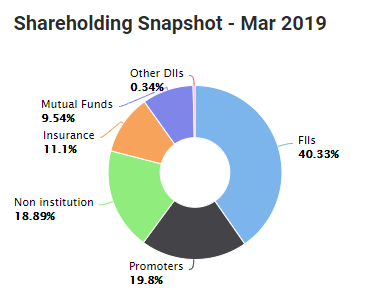

3. Despite rumors of slow growth Yes Bank shares are held in 33 Schemes (9.54%) in Mutual Funds and by 760 FIIs (39.5%).

4. 8 hours ago, Yes Bank acquires 12.79% stake in CG Power. CG Power, formerly known as Crompton Greaves, is one of the largest players in India in the electrical equipment and engineering industry. Headquartered in Mumbai, it has manufacturing facilities in Goa, Gujarat, Karnataka, Maharashtra, Madhya Pradesh, Canada, Belgium, and the United States.

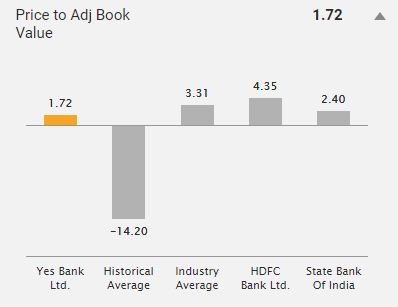

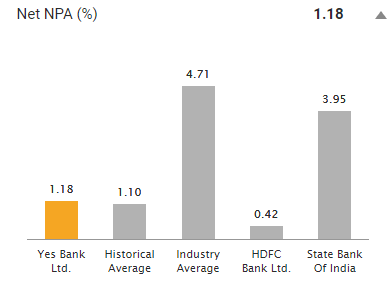

5. At this price, Yes bank is trading just 1.72 times its book value, cheapest among others. Net NPA of Yes Bank is still stable as compared to its peers.

6. Yes, Bank is well placed to deliver healthy loan growth through market share gains (53%) with the strengthening of its Casa franchise and capital raising (common tier-1 CAR at 9%). Its stressed loans have been manageable at 2.5%, and a positive outcome from the central bank’s inspection will ease investor concerns.

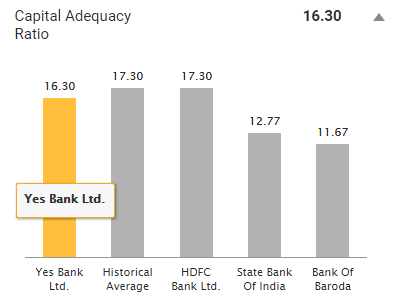

7. The Capital Adequacy Ratio (CAR), which is a measure of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposures is also good among the others even after the breakdown. CASA has grown at 51% CAGR (FY15–18); CASA Ratio of 33.8% of Total Deposits.

8. As per recent research which was done by Motilal Oswal, Balance sheet growth likely to moderate with the bank’s strategy shifting toward building a strong retail franchise and corporate governance/transparency.

Maintains ‘Buy’ with a revised target price of Rs 280 (1.8x FY21E BV)

Thanks!!!

Akshay Seth

invest@equityboxx.com | Linkedin

Read more articles: Equityboxx

Open your zero brokerage demat account here

Comments